Credit Score in the US: How to Check, Improve, and Understand Your Credit Health

Your credit score is like a magic key that unlocks a world of financial opportunities. It impacts everything from getting a dream home and a reliable car to securing the best interest rates on loans and even snagging a sweet apartment. In short, a good credit score can save you money and open doors to a brighter financial future. It shows lenders that you have the history to show your ability to pay back your loans, and that you are a reliable borrower.

Consider it a life hack you can't afford to miss! This article will go over the most asked questions when it comes to your credit score, and equip you with all the knowledge and tools to understand, improve, and master it.

Let's dive in!

How can I check my credit score?

Knowing your credit score is the first step to taking control. You can access free credit reports from the three major credit bureaus: Equifax, Experian, and TransUnion. Each bureau maintains a slightly different report, so your score may vary slightly between them. This doesn't mean there's an error, just that each bureau might weigh certain factors a little differently. Don't worry, these variations are usually minor.

What is a good credit score to have?

The Ultimate Goal: The Excellent Credit Score

Credit scores typically range from 300 to 850. Here's a breakdown to help you understand where you stand:

300-579: This is considered a poor credit score and can limit your financial options.

580-669: This is a fair credit score, but you might qualify for higher interest rates.

670-739: This is a good credit score and allows you access to more favorable loan terms.

740-850: This is an excellent credit score, unlocking the best rates and financial products.

Where can I get a free credit report?

You're entitled to a free credit report from each bureau (Equifax, Experian, and TransUnion) once every year. Think of it as your annual financial checkup! This is a fantastic opportunity to track your progress and hold yourself accountable to the action steps you'll learn in this article.

You can actually get only one free comprehensive credit report from each bureau (Equifax, Experian, and TransUnion) every twelve months through AnnualCreditReport.com.

However, there is some good news!

Weekly Credit Reports: In 2023, due to a permanent change, you can access free weekly credit reports with basic information directly from each bureau through AnnualCreditReport.com. These reports won't include your credit score, but they can be helpful for monitoring activity and potential errors.

Free Equifax Reports (limited time): Currently, there's a temporary program allowing six free credit reports from Equifax per year through AnnualCreditReport.com until 2026. This is a bonus you can take advantage of!

Here's an update on how you can access your credit reports:

Free Annual Credit Reports: Once a year, request your free report from each bureau (https://www.annualcreditreport.com/index.action).

Free Weekly Credit Reports (Basic Information): Check your credit report weekly for free on each bureau's page through AnnualCreditReport.com. (Credit score not included)

Free Equifax Reports (Limited Time): Access up to six free Equifax credit reports per year through AnnualCreditReport.com until 2026. (Take advantage of this!)

By strategically utilizing these options, you can monitor your credit activity and progress throughout the year without penalty.

What are the factors that affect my credit score?

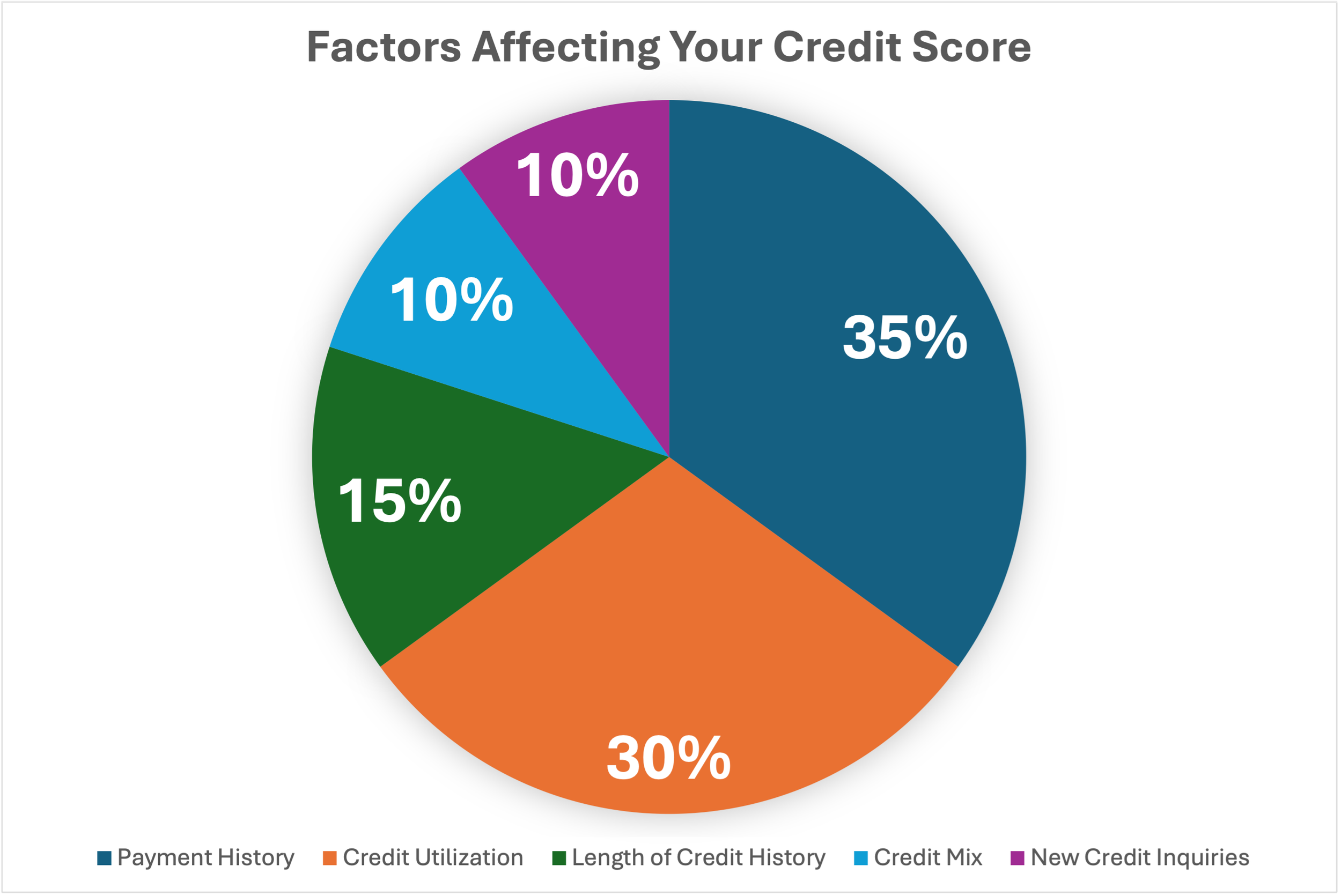

Understanding what factors impact your credit score empowers you to make informed financial decisions. The circle graph above illustrates the relative weight of each factor. Here's a closer look:

Payment History (35%): This is the most crucial factor. Consistent on-time payments significantly boost your score.

Credit Utilization (30%): Keeping your credit card balances low demonstrates responsible credit management.

Length of Credit History (15%): A long credit history with responsible credit use is a positive indicator.

Credit Mix (10%): Having a mix of credit cards, loans, and lines of credit can positively impact your score.

New Credit Inquiries (10%): Applying for too much credit in a short period can lower your score.

Takeaways:

Become a Payment Pro: On-time payments are the single biggest factor affecting your credit score! Set up automatic payments or reminders to ensure you never miss a deadline.

Credit Utilization Matters: Keep your credit card balances low. Aim for a utilization rate below 30% of your credit limit.

How do I improve my credit score?

Even if your credit score isn't ideal right now, don't despair! There are steps you can take to improve it over time. Here are a few key points and strategies:

Starting Score: The lower your starting score, generally the longer it takes to climb significantly. Scores in the upper 500s may see faster improvement than those in the lower 500s or below.

Credit Report Mistakes: If errors on your credit report are bringing down your score, fixing them can lead to a quick jump once they're corrected. This process can take 30-60 days.

Debt Management: Paying down credit card balances and keeping them low (ideally below 30% of your credit limit) is a major factor. This can take several months to show significant improvement.

Payment History: Building a consistent on-time payment track record is crucial. The impact increases over time, but missed or late payments from the past few years will take time to outweigh with a positive payment history. Again, set automatic payments! Even if it is the minimum payment on your credit card instead of the entire statement balance every month.

Here's a general timeframe to consider, but remember it's just an estimate:

Small Improvement (Fair to Good): You might see a bump of 50 points within 6 months with consistent positive actions.

Significant Improvement (Poor to Good or Fair to Excellent): This could take 12-24 months of dedicated effort, depending on the severity of your credit situation.

Here are some resources that can help you improve your credit score:

Free Credit Report: You can access a free credit report from each bureau annually at https://www.annualcreditreport.com/index.action.

Credit Monitoring Tools: Services like Credit Karma offer free credit score monitoring and personalized tips for improvement.

Debt Management Plans: If you're struggling with debt, consider a debt management plan from a reputable credit counseling agency.

The key takeaway is that improving your credit score takes time and consistent effort. By following responsible credit habits and taking advantage of available resources, you can move towards a good or excellent credit score

Embrace Credit Karma (and Other Credit Monitoring Tools): Free services like Credit Karma provide easy access to your credit report and score, along with personalized tips for improvement.

Taking Charge of Your Financial Future

By understanding your credit score and the factors that influence it, you're well on your way to unlocking a brighter financial future. Use the knowledge and tools provided in this article to take control of your credit score and watch your financial opportunities blossom! Remember, it's a journey, not a sprint. Stay motivated, take consistent action, and empower yourself to achieve financial success!